SUCCESS STORY:YETI

Investment Year: June 2012

Industry: Consumer Products

Ownership Profile: Founder-Owned

Exit Year: IPO in October 2018(1)

(1) Cortec exited its investment in YETI through the company’s IPO in October 2018 and subsequent stock sales completed from May 2019 – February 2021.

Situation Overview

YETI is a leading global, branded outdoor products company that designs, markets, and sells premium coolers, drinkware, bags, and other innovative products and accessories. The company sells to a broad base of consumers in the U.S. and internationally through an omni-channel sales strategy, including direct-to- consumer eCommerce, a diverse range of retail partners, and a network of company-owned stores.

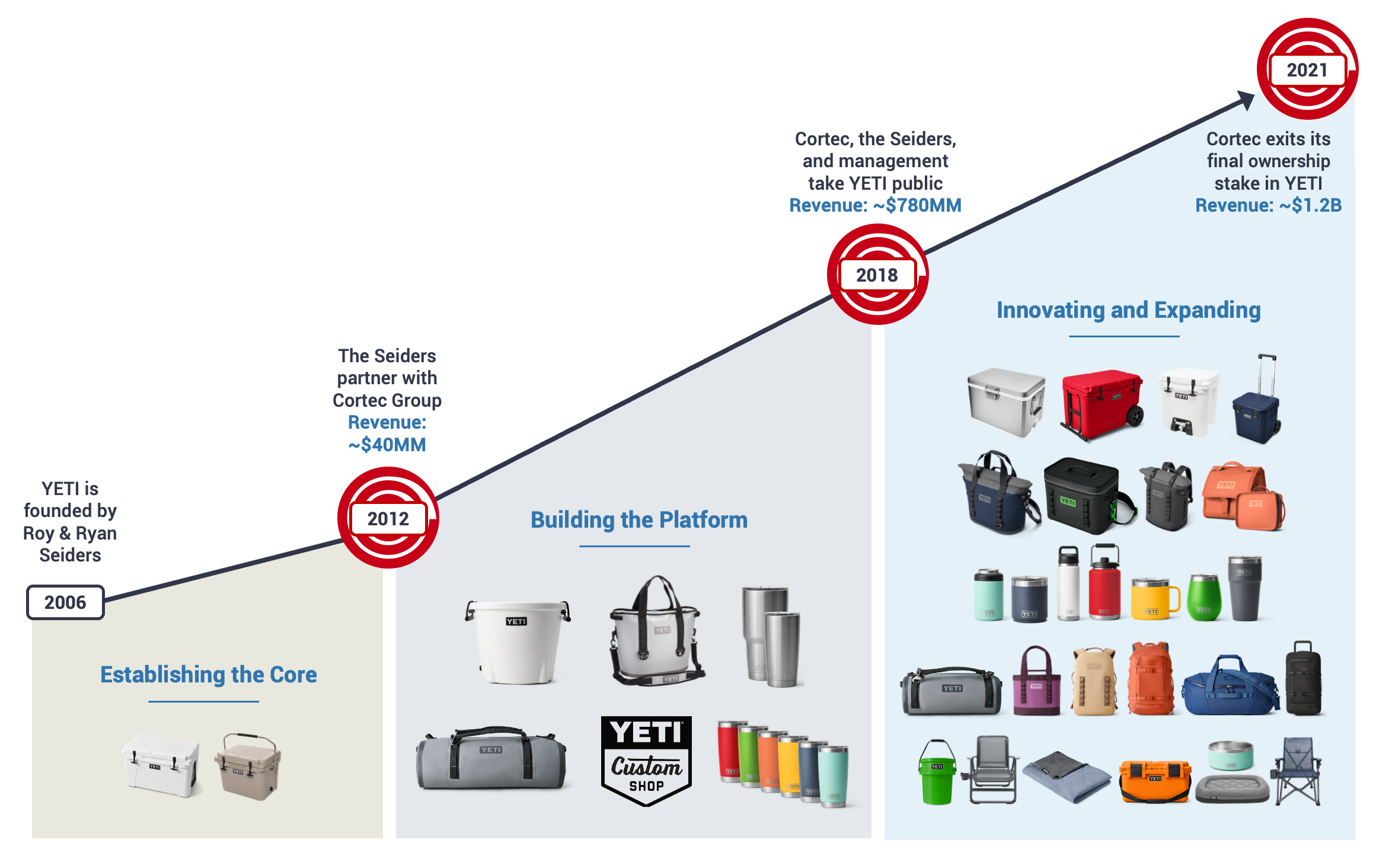

Roy and Ryan Seiders (CEO and President, respectively, at the time of our investment) founded YETI in 2006 with the simple goal of creating a durable, multi-functional, hard shell cooler that would outperform all other alternatives in the market. Prior to Cortec’s ownership, “YETI Coolers” (as it was known at the time) was a single-product business with a relatively small, but fiercely loyal and growing customer base and a strong brand reputation that resonated in the market, but remained largely untapped.

By 2011, the Seiders had grown YETI to ~$40 million in revenue, but recognized the need for a partner to help them realize the full potential of the company. Roy and Ryan chose Cortec over numerous private equity suitors following a competitive sale process and remained significant owners in the company while staying active in the business.

Investment Thesis

YETI offered a rare and compelling opportunity to partner with two successful founders to continue to build an influential and growing lifestyle brand. Despite the company’s early success, the Seiders had reached a point where they required an experienced teammate to help them navigate the next stage of YETI’s evolution. Cortec’s successful track record working with entrepreneur-led, high-growth businesses aligned extremely well with what the company needed.

In addition to YETI’s leading products, brand strength, and market position, the company had an impressive growth trajectory and strong momentum among a fast-growing and passionate customer base. We saw an opportunity to help YETI facilitate continued growth by developing a multi-pronged strategy that included: building the team, introducing a broad line of new products, penetrating consumers in new geographies, expanding distribution channels (including via a direct-to-consumer presence), refining and marketing the YETI brand, and strengthening the operating infrastructure to support these initiatives.

Evolution From Entry to Exit

(1) Includes sales through eCommerce channels (including YETI.com) and company-owned retail stores.

Note: Unless otherwise stated, all statistics are as of YETI’s IPO in October 2018.

Key Cortec Value-Add Initiatives

Unless otherwise stated, all statistics are as of YETI’s IPO in October 2018.

Product and Category Expansion

Outcome

Given the strong performance of the business, Cortec, the Seiders, and management completed an IPO (NYSE:YETI) in 2018. Cortec exited its ownership through the IPO and a series of subsequent share sales completed through February 2021.

Past performance is not necessarily indicative of future returns. Case studies are for illustrative purposes only and do not represent a complete list of investments. There can be no assurance future investments will be comparable in quality or performance.